Saturday, October 15, 2011

Google is All Advertising, All the Time!

So, where does Android fit in to Google's portfolio of capabilities and relationships?

Is Motorola acquisition at around $12B the best use of Google's finances?

Thursday, October 13, 2011

About Google and Platforms

Interesting Business Model from a Polish Gaming Company

Wednesday, October 12, 2011

Lessons from Microsoft & Apple Applied to Energy

I’ve been struggling to find a way to connect the lessons learned from Microsoft and Apple to the energy company I chose for our project (PG&E, a utility in California). In class, Professor Venkatraman mentioned that vertical integration is giving way to horizontal layers with specialized capabilities and that winning requires dominating a layer and connecting across layers. As far as I can tell, PG&E is fighting this and is doing the opposite. The company is involved in almost every aspect of the energy industry from power generation to metering to energy efficiency consulting. I don’t believe they are leading the sector in any of these efforts, which leads me to believe that they haven’t “won” in the way discussed in class.

A large part of this is due to the fact that PG&E, like other utilities, essentially has a regulated monopoly over their region so perhaps some of the same rules don’t apply. They don’t necessarily need to dominate their layer because they don’t seem to face a great deal of competition. However, with the increasing number of Independent Service Operators participating in the market and local initiatives (like this one) aiming to give residents more options when it comes to power generation, it would be wise of PG&E to look at the lessons that can be learned from Microsoft and Apple. There may come a time when PG&E doesn’t have the government regulated “edge” over their competitors and unless they narrow their focus and excel at certain capabilities, they could potentially fall behind.

Lessons from Apple & Microsoft

Microsoft made an investment that allowed Apple to fund its R&D which led to its enormous growth and brought Microsoft Office on Apple products up to par with its Windows counterpart. Apple opened its platform to Internet Explorer and gave up what would come to be ridiculously valuable non-voting stock.

This partnership made both companies stronger and it can serve as an example for the financial industry. The major banks like Bank of America and Chase have seen their ability to charge fees seriously reduced through government regulation. They have resorted to charging new fees to recoup some of that lost revenue which has been met... less than enthusiastically. But the banks, namely Bank of America, Chase and Wells Fargo have partnered to open up a new market, well new for them anyway. clearXchange is the big banks answer to Paypal. It will allow person to person payments in an attempt to capture the enormous market that Paypal has until now basically owned.

The banks face some challenges, namely getting people to switch to clearXchange from Paypal. It will be interesting to see where this partnership goes in the future, will the banks be able to put aside their competitive spirit long enough to create a viable payment network that could rival Paypal?

Tuesday, October 11, 2011

Healthcare value chain

Lesson From Apple: iTunes

Monday, October 10, 2011

Lessons learned from Apple

As the following article notes (http://techland.time.com/2011/07/01/why-competing-with-apple-is-so-difficult/) it is very difficult for other companies to try to compete with the Apple experience because while Apple has control over the hardware, software and services of their products, most other companies only control one of the components and depend on others for the rest.

Well, That Was Qwik!

Interesting move by Netflix, deciding to cancel its split into separate DVD (Qwikster) and Streaming (Netflix) companies (TechCrunch Article on Topic). I think that there are a bunch of lessons to be learned out of this one.

It seems as though Netflix failed big time in one of two areas: either it didn't do sufficient market research to know that its clientele would hate going to two different sites to watch movies, or the company does not trust the market research it conducted. Either way, this is a massive misstep and makes the once business case-worthy company seem pedestrian. The initial move to split DVD rental revenues from streaming revenues makes some sense, and the company was probably right to ignore the outcry from penny-pinching customers who didn't want to pay more for the same service. But this time, the customer has challenged one of Netflix's fundamental strategies moving forward and CEO Reed Hastings apologetically folded. Not a great sign of power.

So what's the next move? Does Netflix simply maintain its current infrastructure, with DVD rentals and streaming on the same site under different subscription plans? Will the DVD rental business fizzle out over the next few years as consumers turn more toward streaming and digital copies? What happens to Netflix's massive inventory of DVDs if rentals go by the wayside? And why hasn't anything been mentioned about the video game rental plan (a la GameFly) since that notorious letter over the summer?

It's going to be interesting to see where Netflix goes from here, but there is definitely a huge chink in the armor now.

Lessons from Apple

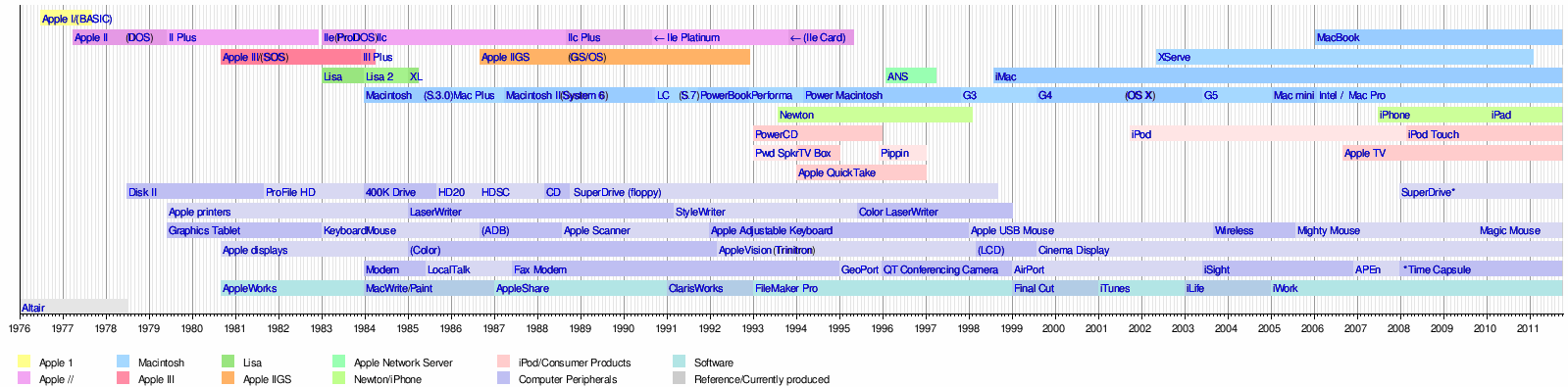

As you can see, Apple introduced very innovative products that were not very successful before Steve Jobs got fired. I believe this allowed Steve to reflect on his failures and when he came back he introduced very successful products at a time when they were needed and would be a success. Farewell Steve.

Sunday, October 9, 2011

A lesson from Apple and Microsoft

In both these cases, these leaders took a long ( and perhaps risky ) position on the opportunities and invested in their belief much before any of the other companies did. I believe that the reason both Apple and Microsoft have been successful is that the bets these companies took for what would work in future turned out to be right. When their view of future did not turn out to be right, or if they were late in responding to the trend, they struggled. For example, after the windows and office success, Microsoft did not take similar long term view of internet and hence it was no longer an innovator on internet and web technologies.

I would argue that the lesson in strategy here is that to become wildly successful, you need to have a view on where things are going in future and put your money in those areas. Assuming that the execution is correct, if your view seemed is right, it will result in windfall, otherwise it is tough luck.